Tomorrow is Halloween, it's also the end of the month, which I'm hoping lots of action happen because I'm trying to beat my September record.

Anyway, I noticed sometime around the middle of this month while I was trying to make some adjustments that it was within the realm of possibilities. I've been consistently having these smaller big up days compared to the few huge up days I had in September and I'm at a good pace to beat it. I had a pretty good day yesterday with the FOMC rate cut, which actually I have to say that for some reason I heard a 25 basis point cut so I went heavily short when it was in fact the expected 50 basis point. Whatever, I made quite a bit on that big dip after the announcement came out. After Wednesday it started to feel real that I actually beat my September record.

I had to make a decision earlier this week whether to miss Thursday or Friday to go to the Spanish Consulate in Houston to get my tourist visa for the cruise I'm not going on around Thanksgiving time. Thursday being the day after Fed announcement, could have lots of action. Friday is the end of the month... tough choice. Because of the fact that I'm only permanent resident status (my family's paper has been filed since 1997... seriously, don't ever try to tell me that gov't is efficient) it makes it a little difficult when traveling abroad. We have to obtain a visa, which is usually not a problem, it's just annoying that they make you jump through a lot of hoops. It's also almost comical when we return to the country they question us at customs why has it been taking so long. Gee, I was wondering if you could shed some light on that.

I drove all the way back from Houston this morning after I got done at the Spanish Consulate to try to make some money at the close. Unfortunately, I got into this UNT that came out with a huge sell imbalance, I'm talking about over 100% and I got some decent size. It started working but then it reversed on me. There was news about it being removed from one S&P index into the other (out of the 600 but into the 400 I think) but I felt comfortable with the huge imbalance. I gave it quite a bit of wiggle room and actually even added into it. Let's just say that I eventually covered it for a loss. I put some orders out up top at the close because of its ridiculous strong up move and he in fact did print up. I got out of about a third of my position but I ended up having to hold the rest over night. Let's hope that I get some help tomorrow. By my rough calculation I need a little over couple thousand dollars to beat my September. I think it's totally possible. Wish me luck!

I'm glad I didn't get too upset over the UNT trade. I mean, yeah, it sucks that I drove all the way back from Houston to lose money. But hey, we play the probabilities and it just didn't work out this time and I think I did let it work against a little too much.

On a side note, there was a little scare in our office risk management wise about a week ago so everybody has been more cautious. Unfortunately I've also been wanting to get my capital raised so I can send out more and bigger orders. Thankfully it's been approved and my buying power is being doubled tomorrow.

Thursday, October 30, 2008

Wednesday, October 29, 2008

My Obama Rally

Michelle Obama that is.

Apparently Michelle was on Leno Tuesday night and they got to talking about wardrobe since there's this big brouhaha over Sarah Palin dropping couple hundred thousand dollars at Neiman Marcus. Michelle talks about how she got her yellow ensemble online at J. Crew and that actually generated a surge in online traffic for specifically what she was wearing. CNBC reported this this morning and we all thought it was funny since it did have a moderate strength. I shorted it a little bit just as a joke really. Well, 2:40 rolls around and imbalance orders came out and JCG had a strong buy imbalance. Seriously, WTF... JCG's previous close was 17.52 and it reached a high of 19.90. That's almost a 13.6% bounce.

I just find the whole thing a bit humorous.

Apparently Michelle was on Leno Tuesday night and they got to talking about wardrobe since there's this big brouhaha over Sarah Palin dropping couple hundred thousand dollars at Neiman Marcus. Michelle talks about how she got her yellow ensemble online at J. Crew and that actually generated a surge in online traffic for specifically what she was wearing. CNBC reported this this morning and we all thought it was funny since it did have a moderate strength. I shorted it a little bit just as a joke really. Well, 2:40 rolls around and imbalance orders came out and JCG had a strong buy imbalance. Seriously, WTF... JCG's previous close was 17.52 and it reached a high of 19.90. That's almost a 13.6% bounce.

I just find the whole thing a bit humorous.

Thursday, October 23, 2008

My Two-Million-Dollar Trade

Some stock was acting wacko today and I went out to put a ridiculous high offer and see what happens. I didn't think I would get filled and I knew if I get filled it was not going to stand. This particular stock trades around $40, $50 but when I got my short sell order filled I got filled at $10,000 for 200 shares, basically I made about $1,990,000. Yeah, obviously it's an erroneous trade and it got broken. You can see from my P&L chart for the day... the money I made today barely show up as a blip. Oh well, at least it was fun to see $2 million in my account.

My Metal Mouth

It's been in the talks for a while but I'm finally taking the steps to get braces. Yeah, I know most people get them while they're younger. What can I say? I don't like dentists or orthodontists. The first musical I've ever seen is Little Shop of Horror. Let's just say that the man-eating plant didn't help my young impression of the dental industry. The upper half of my teeth are really good, it's the bottom row that I'm worried about. My lower left canine is fighting space w/ the pre-molar and causing a cross bite.

My orthodontist is someone that my brother-in-law friends with from dental school. I'm just really concerned about the pain. I thought it might help me with my diet but I'm starting to think that I won't be able to eat anything at all the first few days after I get them. I had the separators in on Tuesday to prepare for next Monday's appointment. Yes, in three days I will have metal in my mouth for the next two years. So far I'm already having trouble chewing.

Somebody just tell me that everything is going to be ok.

My orthodontist is someone that my brother-in-law friends with from dental school. I'm just really concerned about the pain. I thought it might help me with my diet but I'm starting to think that I won't be able to eat anything at all the first few days after I get them. I had the separators in on Tuesday to prepare for next Monday's appointment. Yes, in three days I will have metal in my mouth for the next two years. So far I'm already having trouble chewing.

Somebody just tell me that everything is going to be ok.

Monday, October 20, 2008

My Diet

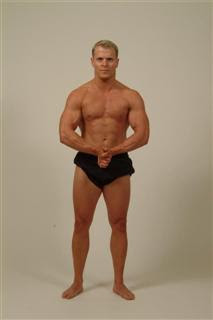

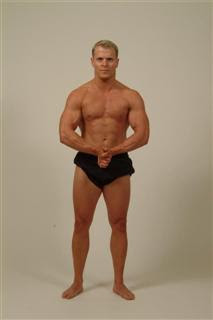

I'm on a diet/work out regimen. I purposely timed it so it would start after my birthday but ends before thanksgiving. Couple of other guys at work has tried it and each of them lost about 10-15 lbs within the one month period.

We saw this from Timothy Ferriss's blog, the author of the 4-Hour Work Week. You can read the details yourself, but roughly you're doing this for a month, with two 30-minute workouts each week and you don't eat any carbs, especially white carbs, or red meat for 6 days of the week. The work out is a little different, too. Instead of doing 3 sets of 10 like usual, you're doing one set to failure with a 5 seconds up, 5 seconds dow cadence. Basically you're lifting less than your normal load, go freakishingly slow and lift until you can't anymore.

I've been on it for a week now. It's really tough the first week. I found out that milk has a lot of carbs therefore it's banned from my diet which sucks b/c I love milk. It's also a problem since so much of Asian cuisine revolves around rice and noodle. So far there hasn't been a dramatic difference yet. I've only dropped about 3-4 lbs and that could be just water weight. However, I do feel fitter and things are looser---like my pants and watch (yipee, I'm losing the stubborn wrist fat that I've always wanted to lose).

There was a young alumni happy hour last week and I've already planned to have my off day on Friday so it was excruciating for me to just sip on a glass of wine and pass on the free cookies they had at the events. Of course my friends would wolf down the cookies right in front of me to tease me, but somehow I made through it.

We saw this from Timothy Ferriss's blog, the author of the 4-Hour Work Week. You can read the details yourself, but roughly you're doing this for a month, with two 30-minute workouts each week and you don't eat any carbs, especially white carbs, or red meat for 6 days of the week. The work out is a little different, too. Instead of doing 3 sets of 10 like usual, you're doing one set to failure with a 5 seconds up, 5 seconds dow cadence. Basically you're lifting less than your normal load, go freakishingly slow and lift until you can't anymore.

I've been on it for a week now. It's really tough the first week. I found out that milk has a lot of carbs therefore it's banned from my diet which sucks b/c I love milk. It's also a problem since so much of Asian cuisine revolves around rice and noodle. So far there hasn't been a dramatic difference yet. I've only dropped about 3-4 lbs and that could be just water weight. However, I do feel fitter and things are looser---like my pants and watch (yipee, I'm losing the stubborn wrist fat that I've always wanted to lose).

There was a young alumni happy hour last week and I've already planned to have my off day on Friday so it was excruciating for me to just sip on a glass of wine and pass on the free cookies they had at the events. Of course my friends would wolf down the cookies right in front of me to tease me, but somehow I made through it.

Sunday, October 19, 2008

My Giant Douche and Turd Sandwich

Some people have said that I watch too much The Daily Show... some straight out call me a cynic. You know what? They're right.

I try to stay away from political talks and what not b/c it just annoys me. Nobody really gives a damn what the other side thinks. All they're hearing is how the other side disagrees with them and all they're thinking in their head is how they're going to poke holes in their arguments or how to rip their opponents a new one with some trivial statistic. I don't want to impose my political views on anyone. If this post bores you or upsets you, feel free to stop reading anytime.

I still remember this episode of South Park from the 2004 election. It was called "Douche and Turd." I don't watch South Park that often. I do think it's funny and they hit it right on the mark when the episode is some kind of social satire like the Douche and Turd episode. It's a lot like The Simpson in a way. It's just gross and crude sometimes and I don't necessary like the means they try to achieve comedy all the time. This episode aired in late October in 2004, just right before the election.

The main plot is that PETA is protesting the South Park Elementary School's usage of cow as its mascot so to appease PETA the school is voting between a Giant Douche or a Turd Sandwich for its new mascot. Dividing opinions form; conflicts ensue. Stan, one of the main characters didn't see the point of voting between the two joke candidates and there's a whole bunch of other stuff that happens in that episode including an appearance by P.Diddy and his Vote or Die campaign. At the end of the episode, Stan's dad tells Stan at the dinner table that all votes matter even if it's for a losing cause, because "you see, it's always going to be between a giant douche and a turd sandwich."

That's kind of how I feel. It's easy to be cynical. Frankly, my dear, I don't give a damn.

In case you feel I have the wrong attitude, I have to let you know about my experience with politics growing up. This is not to justify my attitude (b/c I don't feel I'm wrong in the first place); this is just so you can gain some understanding, which is what we should all do regardless in politics or not. Growing up in Taiwan, I have seen plenty of bribery that went on to get business deals done, straight up buying votes, and just simply a joke of a government. I have seen friends of my dad throwing dinner parties and make under the table deals in order to secure votes. In the US, it exist as well, just not in such obvious forms. I just simply cannot trust the people in power are making decisions with OUR best interest in mind. It wasn't that George Bush doesn't care about black people. George Bush doesn't care period. Barbara Bush and 90% of Republicans in Washington is surprise to find that we still have poor people in America when Katrina hit. "I thought we got rid of them when Reagan was in office."

It's just all a big joke to me now. I remember when I believe in all this "democratic process." In high school I believed people could make a difference and I got involved in Student Council but I quickly saw that there's no such thing as leadership in that organization. Everybody was just using that to pad their college application. Every year we fight to be able to have lunches off campus, at least maybe for the senior or freshman and each year the administrators shut us down. Eventually we quit trying and just go on eating our cookies during StuCo meetings.

My freshman year in college I got involved w/ Student Government again. I thought this was going to be different. This is college. People care and there are real issues to take care of. Well, I was half right. There are real issues but instead they waste 3 hours each Tuesday night in the SSG building promoting and debating agendas of no real interest to us students. It's still a popularity contest. Which tickets has more cool people from different greek organizations ends up sweeping the votes. Each year we want lower tuition and more benefits for the students and each year administrators shut us down. Eventually we quit trying and go on fighting about things that look like we're making a difference, like the Cesar Chavez statue. Oh don't get me wrong, I'm not some anti-Cesar Chavez asshole or I don't think he deserves a statue. Each student ended up contributing I believe $2 out of their student fees to build that statue and did it provide a better student life for us? I guess you could make the argument that now you walk by the West Mall you feel slightly more inspired instead of the urge of going up the Main Tower and sniper-rifle all the people that are trying to hand you a flyer.

Now that in the real government, I'm inclined to have the same feeling I did in high school and college. I've been to Young Democrats AND Young Republicans meetings. Quite honestly, they're both just about equally clueless. The last time I engaged in an actual talk about politics with a friend he said he was voting for McCain and I probed "Why?" "No reason; mostly because I can't stand Obama." Again, I'm not here to impose my view on who I think is the better candidate or fit to lead our country. I just feel like in this YouTube/MTV era it's not about leadership or the policies anymore. It's just all about who's cool or funny. Whatever happen to leaders like FDR and Lincoln? It seems like starting with Nixon we just have these likable guys with questionable leadership skills, or as I'd like to call it, Ron Paul clones (I do have some reservations about putting Reagan in this category though). You can even make arguments against JFK and LBJ. I blame this on the invention of television :-P

I guess the next time someone says to me "how can you be so cynical" I have to respond "how can you be so naive." I don't know what to do from now on. I'm trying to remember how I coped when I found out Santa wasn't real and use that same methodology.

I try to stay away from political talks and what not b/c it just annoys me. Nobody really gives a damn what the other side thinks. All they're hearing is how the other side disagrees with them and all they're thinking in their head is how they're going to poke holes in their arguments or how to rip their opponents a new one with some trivial statistic. I don't want to impose my political views on anyone. If this post bores you or upsets you, feel free to stop reading anytime.

I still remember this episode of South Park from the 2004 election. It was called "Douche and Turd." I don't watch South Park that often. I do think it's funny and they hit it right on the mark when the episode is some kind of social satire like the Douche and Turd episode. It's a lot like The Simpson in a way. It's just gross and crude sometimes and I don't necessary like the means they try to achieve comedy all the time. This episode aired in late October in 2004, just right before the election.

The main plot is that PETA is protesting the South Park Elementary School's usage of cow as its mascot so to appease PETA the school is voting between a Giant Douche or a Turd Sandwich for its new mascot. Dividing opinions form; conflicts ensue. Stan, one of the main characters didn't see the point of voting between the two joke candidates and there's a whole bunch of other stuff that happens in that episode including an appearance by P.Diddy and his Vote or Die campaign. At the end of the episode, Stan's dad tells Stan at the dinner table that all votes matter even if it's for a losing cause, because "you see, it's always going to be between a giant douche and a turd sandwich."

That's kind of how I feel. It's easy to be cynical. Frankly, my dear, I don't give a damn.

In case you feel I have the wrong attitude, I have to let you know about my experience with politics growing up. This is not to justify my attitude (b/c I don't feel I'm wrong in the first place); this is just so you can gain some understanding, which is what we should all do regardless in politics or not. Growing up in Taiwan, I have seen plenty of bribery that went on to get business deals done, straight up buying votes, and just simply a joke of a government. I have seen friends of my dad throwing dinner parties and make under the table deals in order to secure votes. In the US, it exist as well, just not in such obvious forms. I just simply cannot trust the people in power are making decisions with OUR best interest in mind. It wasn't that George Bush doesn't care about black people. George Bush doesn't care period. Barbara Bush and 90% of Republicans in Washington is surprise to find that we still have poor people in America when Katrina hit. "I thought we got rid of them when Reagan was in office."

It's just all a big joke to me now. I remember when I believe in all this "democratic process." In high school I believed people could make a difference and I got involved in Student Council but I quickly saw that there's no such thing as leadership in that organization. Everybody was just using that to pad their college application. Every year we fight to be able to have lunches off campus, at least maybe for the senior or freshman and each year the administrators shut us down. Eventually we quit trying and just go on eating our cookies during StuCo meetings.

My freshman year in college I got involved w/ Student Government again. I thought this was going to be different. This is college. People care and there are real issues to take care of. Well, I was half right. There are real issues but instead they waste 3 hours each Tuesday night in the SSG building promoting and debating agendas of no real interest to us students. It's still a popularity contest. Which tickets has more cool people from different greek organizations ends up sweeping the votes. Each year we want lower tuition and more benefits for the students and each year administrators shut us down. Eventually we quit trying and go on fighting about things that look like we're making a difference, like the Cesar Chavez statue. Oh don't get me wrong, I'm not some anti-Cesar Chavez asshole or I don't think he deserves a statue. Each student ended up contributing I believe $2 out of their student fees to build that statue and did it provide a better student life for us? I guess you could make the argument that now you walk by the West Mall you feel slightly more inspired instead of the urge of going up the Main Tower and sniper-rifle all the people that are trying to hand you a flyer.

Now that in the real government, I'm inclined to have the same feeling I did in high school and college. I've been to Young Democrats AND Young Republicans meetings. Quite honestly, they're both just about equally clueless. The last time I engaged in an actual talk about politics with a friend he said he was voting for McCain and I probed "Why?" "No reason; mostly because I can't stand Obama." Again, I'm not here to impose my view on who I think is the better candidate or fit to lead our country. I just feel like in this YouTube/MTV era it's not about leadership or the policies anymore. It's just all about who's cool or funny. Whatever happen to leaders like FDR and Lincoln? It seems like starting with Nixon we just have these likable guys with questionable leadership skills, or as I'd like to call it, Ron Paul clones (I do have some reservations about putting Reagan in this category though). You can even make arguments against JFK and LBJ. I blame this on the invention of television :-P

I guess the next time someone says to me "how can you be so cynical" I have to respond "how can you be so naive." I don't know what to do from now on. I'm trying to remember how I coped when I found out Santa wasn't real and use that same methodology.

Thursday, October 16, 2008

My "What's Next?"

I'm at a place right now where I'm showing pretty good consistency and it's not rare for me to show up in the company's top performer report. Although, the market has been active and it's been good for us the past month and a half or so. I'm a little concerned regarding how I'm going to hit my numbers when a slow month comes along. I know still have the tendency to churn a little bit and that's what I need to work on. Jane, my coach, and our Managing Director have all said that my P&L will be a lot higher than before even if a slow month does come. Theoretically I am making better decisions and managing my size better as well.

So what's next? I definitely want to become an HP trader and take on students myself but that seems to be further out in the time line. Jason, my MD (managing director), thought I was impatient. It's really just that I don't know what to shoot for now. I'm happy with the check I'm getting but I want to get to the next level. From my conversation with Jason yesterday, here's what I think I can to grow even more:

As I went along I think people found out about it somehow. I know someone posted the link to my blog in a discussion board out there. The guy that sits next me that started in March moved from San Francisco area read my blog before he took the offer. It makes me wonder how many new traders have read my blog and if that actually had any influence on their decision. If it does than I'm missing out some serious referral checks. Let me just say that this is not a recruiting tool for Kershner. HR and management has no control on what I say on here and whatever ends up here is just my personal opinion, not that of Kershner Trading. I've been thinking about posting more stuff about trading and technical stuff, but I decided against that. There's plenty of other blogs out there that do a good job providing market commentary and technical analysis. I'll update my links sections the ones I read regularly in my Google Reader. I'll just post on the trades that worked out really well or disastrous for me. I'm going to lean more on the personal style. This is blog is for me to read and review in the future like I said and any other friends or family that want to know what I'm up to, mixed in with a few funny posts and what not.

So what's next? I definitely want to become an HP trader and take on students myself but that seems to be further out in the time line. Jason, my MD (managing director), thought I was impatient. It's really just that I don't know what to shoot for now. I'm happy with the check I'm getting but I want to get to the next level. From my conversation with Jason yesterday, here's what I think I can to grow even more:

- Take bigger size when it's appropriate and stretch myself a little bit maybe once or twice a week where I'm a little nervous or uncomfortable with the size I'm in.

- Analyze strengths and weakness--there's no need to be good at everything is what Jason told me, which is completely the opposite of my inherent personality. I'm like Skylar from Heroes. I have this hunger of wanting everybody's powers. X Trader is good trading off of IBD data? I want that. Y trader is the best pre-market traders? Great, I need to get his power, too. There are also plays revolving around high dollar stocks, penny stocks, and pair trades.

- I'm doing great right at the close or post market. Take more shares and for the iShares that I play, know exactly what I need to hedge it with if it looks like I can't get out.

- I have some trouble in the middle of the day (much like the rest of the company); dial back the shares and more selective with trades after 10:30am. I think also a lot of times I should be playing the reversals when a stock is up or down huge but being the momentum trader that I am I go short those bounces or long the retracement. Those happen a little earlier than 10:30 though. The other stuff is probably just churning. (all time in CST)

- Wednesday is just terrible for me relative to other days for some reason... It used to be I would get burned sometimes when oil numbers came out but not anymore. Still, I'm not doing as well on Wednesdays compared to the rest of the week. It could be a lack of focus in mid week or that I just have some predisposed belief that I suck on Wednesdays.

- I'm sucking it up on certain oil stocks like PBR and HK... and the banking ETFs and stocks I'm not doing too well either. Adjustment is needed or don't trade it at all.

- I'm doing well with EWZ. EEM and FXI kind of sucked after the split. Jason recommends that I find another ETF that I can hone in and trade well.

- I have pretty high winning percentage, about 60%, but my risk reward could be better, aka stretching out my winners and cutting the losers quicker, and I'd like my duration to be longer as well. I do believe though that if I've establish a trading style that works for me I don't need to do any heavy adjusting. Why try to be someone I am not, right?

As I went along I think people found out about it somehow. I know someone posted the link to my blog in a discussion board out there. The guy that sits next me that started in March moved from San Francisco area read my blog before he took the offer. It makes me wonder how many new traders have read my blog and if that actually had any influence on their decision. If it does than I'm missing out some serious referral checks. Let me just say that this is not a recruiting tool for Kershner. HR and management has no control on what I say on here and whatever ends up here is just my personal opinion, not that of Kershner Trading. I've been thinking about posting more stuff about trading and technical stuff, but I decided against that. There's plenty of other blogs out there that do a good job providing market commentary and technical analysis. I'll update my links sections the ones I read regularly in my Google Reader. I'll just post on the trades that worked out really well or disastrous for me. I'm going to lean more on the personal style. This is blog is for me to read and review in the future like I said and any other friends or family that want to know what I'm up to, mixed in with a few funny posts and what not.

Monday, October 13, 2008

My "That's What She Said"

I came across this today at work. It's sad to see that they still give out detentions for stupid reasons in high school.

There was one time where somebody on my team was long a stock and he said "get up you dick!" over our conference call on Skype. That was a very nice "that's what she said" moment.

There was one time where somebody on my team was long a stock and he said "get up you dick!" over our conference call on Skype. That was a very nice "that's what she said" moment.

Saturday, October 11, 2008

My Relax

In the spirit of keeping things light and perhaps help you (and me) forget about all this dooms day, end-of-the-world, Armageddon talk b/c the stock market is getting out of hand once again, I'm posting these humor pics that I came across either in my RSS feed or people from work sent me. I particularly like the Halloween one since it's coming up soon.

Wednesday, October 8, 2008

My Pair Trades

I'm trying out some pair trades on Facebook. The idea is to long the strong ones in the industry and short the weaker ones or I was going to pair trade it off of the ETF, so say short the ETF but long the leaders that ETF holds or long the ETF but short the weaker ones.

I'm trying out the OIH, XOP, MOO, EWZ, PPH, or a combination of stocks in those ETFs... and I do want to try out the financials like KBE and UYG but with the short ban (which ends tonight) it's a little harder to gauge. I want to find things that are close in value or exactly half or a third to judge how many shares to take

I already longed 60,000 shares of MON and shorted 30,000 shares of AGU and MOS since those two's value is roughly half of MON. I will probably put on 50,000 shares of POT long with 33,500 shares of AGU and MOS short each when the market is slow MOS and AGU has a combined price of roughly 33% less than of POT so I'm shorting 33% more shares to match. I don't know if exactly that math makes sense when it's translated into dollar figures but since it's all an experiment I don't really care. In addition, I'm going to put on 45,000 shares OIH short and split my longs among RIG, SLB, and DO. The combined value of those threes is about twice the value of OIH so I'm probably going to do 7,500 shares each for 22,500 shares or half of the number of OIH shares I'm going to put on. For EWZ the max it'll let me short on facebook is 13,350 shares so I'm going to match that by longing 17,800 shares of PBR. PPH I can only short about 37,000 shares so I'll then split that in half and long 18,500 shares of JNJ and ABT.

It kind of makes sense to me with the numbers and the shares and all that in my but I'm not sure and if it's that easy I'm sure everybody out there would be doing it. Supposedly other people who do these kind of trades have some complicated algorithm, etc etc... woooo, wouldn't it be funny if I just crack it right now?

I'm at a point when I'm satisfied with my trading system and I want to continue to expand my repertoire. I have faith in the way that I trade that I'm going to consistently make money.

I'm trying out the OIH, XOP, MOO, EWZ, PPH, or a combination of stocks in those ETFs... and I do want to try out the financials like KBE and UYG but with the short ban (which ends tonight) it's a little harder to gauge. I want to find things that are close in value or exactly half or a third to judge how many shares to take

I already longed 60,000 shares of MON and shorted 30,000 shares of AGU and MOS since those two's value is roughly half of MON. I will probably put on 50,000 shares of POT long with 33,500 shares of AGU and MOS short each when the market is slow MOS and AGU has a combined price of roughly 33% less than of POT so I'm shorting 33% more shares to match. I don't know if exactly that math makes sense when it's translated into dollar figures but since it's all an experiment I don't really care. In addition, I'm going to put on 45,000 shares OIH short and split my longs among RIG, SLB, and DO. The combined value of those threes is about twice the value of OIH so I'm probably going to do 7,500 shares each for 22,500 shares or half of the number of OIH shares I'm going to put on. For EWZ the max it'll let me short on facebook is 13,350 shares so I'm going to match that by longing 17,800 shares of PBR. PPH I can only short about 37,000 shares so I'll then split that in half and long 18,500 shares of JNJ and ABT.

It kind of makes sense to me with the numbers and the shares and all that in my but I'm not sure and if it's that easy I'm sure everybody out there would be doing it. Supposedly other people who do these kind of trades have some complicated algorithm, etc etc... woooo, wouldn't it be funny if I just crack it right now?

I'm at a point when I'm satisfied with my trading system and I want to continue to expand my repertoire. I have faith in the way that I trade that I'm going to consistently make money.

Tuesday, October 7, 2008

My Failed Rally

It looks like we're still heading lower. It looked good in the morning but mid day, coincidentally (or maybe as V would say, only the mere illusion of coincidence) when Bernanke came on CNBC and the FOMC minute were about to come out we started making lower highs down trend again. In fact, we even took out the lows made on Monday. I'm going to continue to look for confirmations in the price action and volume. The short ban ends on midnight Wednesday so Thursday should be very interesting. With the financial shorts back in play... there's just no point in trying to play the long side right now. I hope to see that bottom confirmation sometime within the next 5-10 days. If this doesn't hold up... next stop: Dows 8800 or 7700ish range.

I got short some shares at the close but I didn't get the ideal price that I wanted and I panicked. I covered for a bigger loss than I'd like. I really wasn't thinking clearly at that point with everything going on at the close. It was stupid really. I should've at least just hedge it with something. I had absolutely no idea how we might open the next day at that moment... so I just took the loss. Now that seeing Asian getting beat up I'm pretty sure I could've made a least a couple thousand dollars right at the open tomorrow. I still finished up the day, quite significantly. Sometimes I feel as if I want to lose money. You might think: that's crazy! Why would you want to lose money? It's actually quite common. It's a psychological thing. Some traders do very well and go on a streak but a part of them don't believe they deserve this money. It's like a form of cognitive dissonance and they adjust by subconsciously taking some losses.

My parents are back in Austin again. The suspcious Jason believe he makes a lot more money when his parents are out of the 512 area code and doesn't like Wednesday. Just so happens tomorrow is Wednesday as well. Whoopi! Let's just be careful and not let this get to my head.

I'm trying to think of some fundamental plays again. With oil and other commodity prices down sharply, I was thinking of longing stuff like airlines, transport, and food companies. Unfortunately if we do have a global slowdown that's going to take the transport stocks down with it. Airlines... we'll see. It's hard to get on board (no pun intended) with such a crappy industry but once we've bottomed out this might be the first group that I look to.

I got short some shares at the close but I didn't get the ideal price that I wanted and I panicked. I covered for a bigger loss than I'd like. I really wasn't thinking clearly at that point with everything going on at the close. It was stupid really. I should've at least just hedge it with something. I had absolutely no idea how we might open the next day at that moment... so I just took the loss. Now that seeing Asian getting beat up I'm pretty sure I could've made a least a couple thousand dollars right at the open tomorrow. I still finished up the day, quite significantly. Sometimes I feel as if I want to lose money. You might think: that's crazy! Why would you want to lose money? It's actually quite common. It's a psychological thing. Some traders do very well and go on a streak but a part of them don't believe they deserve this money. It's like a form of cognitive dissonance and they adjust by subconsciously taking some losses.

My parents are back in Austin again. The suspcious Jason believe he makes a lot more money when his parents are out of the 512 area code and doesn't like Wednesday. Just so happens tomorrow is Wednesday as well. Whoopi! Let's just be careful and not let this get to my head.

I'm trying to think of some fundamental plays again. With oil and other commodity prices down sharply, I was thinking of longing stuff like airlines, transport, and food companies. Unfortunately if we do have a global slowdown that's going to take the transport stocks down with it. Airlines... we'll see. It's hard to get on board (no pun intended) with such a crappy industry but once we've bottomed out this might be the first group that I look to.

Monday, October 6, 2008

My Bottom?

I think we've bottomed.

*gasp*

I really don't like to call tops or bottoms. People come on TV and call bottom all the time. But they're getting paid to say what they think. I don't. I'm just blogging about what's going on with me and what's going through this tiny head of mine. Of course, when you call top or bottom, you're sticking your neck out and from time to time you're going to be wrong. I mean, my god, Jim Cramer called the bottom back when SPY was trading at like 126, 127 I think (SPY closed around 105 today). And I understood why he would call the bottom right there. I remember that day there were negative news about MER or MS (I always get them mixed up a little bit), but the market seems to just brush it off completely, which you could interpret as that the market has already priced in all the bad news.

BAC just announced they're going to cut dividends so I think we might gap down again tomorrow depending on how Asia and Europe do. We also have the FOMC minutes coming out at 1pm CST. Lots have changed since the last Fed meeting. I think people are going to read into it whether there's a chance of a rate cut coming up in three weeks. VIX is way up at 58. There's panic and I think we've finally flushed all the weak hands out. I lost a lot of money in the middle of the day churning away. It just seemed like the buyers and sellers had come to a stand still and the market wasn't making any real moves and I was getting stopped out of my longs and shorts left and right. I would be looking to buy some stocks around 9:30, 10:00 CST with some slightly wider stop placed.

We're going to weed out the weak and after the smoke clear, I think we'll be surprised how strong WFC is.

*gasp*

I really don't like to call tops or bottoms. People come on TV and call bottom all the time. But they're getting paid to say what they think. I don't. I'm just blogging about what's going on with me and what's going through this tiny head of mine. Of course, when you call top or bottom, you're sticking your neck out and from time to time you're going to be wrong. I mean, my god, Jim Cramer called the bottom back when SPY was trading at like 126, 127 I think (SPY closed around 105 today). And I understood why he would call the bottom right there. I remember that day there were negative news about MER or MS (I always get them mixed up a little bit), but the market seems to just brush it off completely, which you could interpret as that the market has already priced in all the bad news.

BAC just announced they're going to cut dividends so I think we might gap down again tomorrow depending on how Asia and Europe do. We also have the FOMC minutes coming out at 1pm CST. Lots have changed since the last Fed meeting. I think people are going to read into it whether there's a chance of a rate cut coming up in three weeks. VIX is way up at 58. There's panic and I think we've finally flushed all the weak hands out. I lost a lot of money in the middle of the day churning away. It just seemed like the buyers and sellers had come to a stand still and the market wasn't making any real moves and I was getting stopped out of my longs and shorts left and right. I would be looking to buy some stocks around 9:30, 10:00 CST with some slightly wider stop placed.

We're going to weed out the weak and after the smoke clear, I think we'll be surprised how strong WFC is.

Friday, October 3, 2008

My New Trades

So I was talking to another trader on the floor yesterday about pair trades. I know he does a lot of that and I've been pretty fascinated by the idea. I've been looking for some trade ideas to automate for a while. The thing with pair trade though is that what I was thinking about is the opposite of what Brian or conventional play which is to play for the divergence to converge back. I was thinking that certain days EWZ looks a lot stronger/weaker compared to SPY, but I was also just looking at the dollar amount whereas most pair traders look at percentages.

There's still a lot of homework I need to do on this. There are traders that base trades off of complicated algorithm. How do I find the pairs? How do I establish what's the norm for them and what would trigger the trade? Should I look at the change in dollar amount or percentage? Do I take a different amount of shares for the long/short? Should I trade in the direction of the divergence or trade for them to converge? If it's not working, how much room do I give it or willing to lose? If it's working for me, what's my exit strategy in that case as well?

So far I only have the LVS-MGM and SPWRA-SPWRB pair that I'm trying out. If you know any other pairs that's been working for you, let me know.

There's still a lot of homework I need to do on this. There are traders that base trades off of complicated algorithm. How do I find the pairs? How do I establish what's the norm for them and what would trigger the trade? Should I look at the change in dollar amount or percentage? Do I take a different amount of shares for the long/short? Should I trade in the direction of the divergence or trade for them to converge? If it's not working, how much room do I give it or willing to lose? If it's working for me, what's my exit strategy in that case as well?

So far I only have the LVS-MGM and SPWRA-SPWRB pair that I'm trying out. If you know any other pairs that's been working for you, let me know.

Thursday, October 2, 2008

My Retirment Plan

Where am I putting my money? For my retirement I'm actually following the Good to Great Index or method. Good to great is a book by Jim Collins that talks about companies that are able to consistently perform and adjust to make the company Built to Last.

The Good to Great companies

- Abbot Laboratories (ABT)

- Circuit City (CC)

- Fannie Mae (FNM)

- Gillette (got bought out by Proctor I think)

- Kimberly-Clark (KMB)

- Kroger (KR)

- Nucor (NUE)

- Philip Morrs/Altria (PM/MO)

- Pitney Bowes (PBI)

- Walgreen (WAG)

- Wells Fargo (WFC)

The Built to Last companies:

- 3M (MMM)

- American Express (AXP)

- Boeing (BA)

- Citygroup (C)

- Disney (DIS)

- Ford (F)

- General Electric (GE)

- Hewlett Packard (HPQ)

- IBM (IBM)

- Johnson & Johnson (JNJ)

- Marriott (MAR)

- Merck (MRK)

- Motorola (MOT)

- Nordstrom (JWN)

- Phillip Morris/Altria (PM/MO)

- Proctor & Gamble (PG)

- Sony (SNE)

- Wal*Mart (WMT)

There are some real crap on this list though... FNM is not worth crap now, MOT is crap, CC is double crap, F is crap to the 5th power. If you look at the chart for ALLLL the way back, and I mean back in like the 80's or even further, the ones that actually do have an uptrend I like are (wth the current dividend % following) : ABT (2.44%), KMB (3.54%), KR (1.30%), PM (4.40%), MO (6.37%), WFC (3.87%), MMM (3.05%), JNJ (2.71%), PG (2.24%).

Some of the companies I really like as well like BA and IBM and some technically do have an uptrend but I didn't include them b/c the slope of the trend is not as great or almost flat or there's a lot more volatility than I'd like. So seriously, if you are putting in money into your 401(k), IRA or whatever retirement/pension fund you have like SEP or VUL... just go w/ these companies. Personally I'm even more selective. I'm down to just PM, MO, WFC, JNJ, KMB, and PG. Six companies... well, it used to be 5 before the PM/MO spin off. I simply just buy these shares no matter what price they are and I reinvest the dividends. I don't care if they go up or down. Will this work? Let's see... I'm almost 25 now, I'll let you know in 40 years. So let's talk again in 2048.

My Little Blow Up

Today was suppose to be a great day. It looked like I was going to be in the company's top performer's list for the 5th straight day, but then in the afternoon I took two small hits. Instead of lightening up my shares or stop trading for a while I still went at it full steam ahead and this time I held my loser for much more room than I'd normally give it. I lost my day's profit and then some. I really haven't had a blow up like this lately, even if it's a small one. I just kind of lost my head... sigh...

The House is going to vote on the new bail out bill. Look, I understand why people feel that this bill should not be passed. Yes, this is the creation of Wall Street greed. No, we should not be in this situation. Judging from the stuff I read and watch, it feels like most everybody do not want this bill to be passed b/c the average joes should not have to pay for the sins of the greed of evil corporations. Meanwhile, people that are in the financial industry believe this bill needs to be passed. Whenever you see a fund manager or whoever they have on CNBC they all say that the bail out needs to be passed, but when you interview the John Smiths from Iowa City, Iowa or wherever that's way the hell away from New York City they are all against the bill.

What do I think? I quite frankly don't know what to think anymore. I believe the Congress should do something. That something was better regulation and accounting standards a LOOONNG time ago. I mean, c'mon, did we learn nothing from the savings & loan crisis in the 80's? Now that we're here, what do we do? I don't have the answer. Believe it or not, Congress doesn't quite have the answer. I mean no offense but no Congressman or Congresswoman fully understands the illiquid financial instruments that we're dealing with here. Not McCain, not Obama, not Pelosi. Hank Paulson has a plan but he sure didn't do a good job explaining and selling the plan. I don't want to place blame and point fingers. All I really hoping is that Congress is doing the right thing instead of simply politicking b/c we have an election coming, voting with personal or the party's agenda.

Hey, take the whole anger and greed thing out... if something is not done, seriously, it's going to affect all of us. Yes, even you who stuff money under your mattress. Without a healthy credit market business is not going to be able to function properly and the economy goes down the crapper, which translate into weaker dollar so even if you don't have any stocks, 401(k), pension plan of any kind and stuff your money under the mattress that money is going to be worth less. I fear for you, for me, for the people.

The House is going to vote on the new bail out bill. Look, I understand why people feel that this bill should not be passed. Yes, this is the creation of Wall Street greed. No, we should not be in this situation. Judging from the stuff I read and watch, it feels like most everybody do not want this bill to be passed b/c the average joes should not have to pay for the sins of the greed of evil corporations. Meanwhile, people that are in the financial industry believe this bill needs to be passed. Whenever you see a fund manager or whoever they have on CNBC they all say that the bail out needs to be passed, but when you interview the John Smiths from Iowa City, Iowa or wherever that's way the hell away from New York City they are all against the bill.

What do I think? I quite frankly don't know what to think anymore. I believe the Congress should do something. That something was better regulation and accounting standards a LOOONNG time ago. I mean, c'mon, did we learn nothing from the savings & loan crisis in the 80's? Now that we're here, what do we do? I don't have the answer. Believe it or not, Congress doesn't quite have the answer. I mean no offense but no Congressman or Congresswoman fully understands the illiquid financial instruments that we're dealing with here. Not McCain, not Obama, not Pelosi. Hank Paulson has a plan but he sure didn't do a good job explaining and selling the plan. I don't want to place blame and point fingers. All I really hoping is that Congress is doing the right thing instead of simply politicking b/c we have an election coming, voting with personal or the party's agenda.

Hey, take the whole anger and greed thing out... if something is not done, seriously, it's going to affect all of us. Yes, even you who stuff money under your mattress. Without a healthy credit market business is not going to be able to function properly and the economy goes down the crapper, which translate into weaker dollar so even if you don't have any stocks, 401(k), pension plan of any kind and stuff your money under the mattress that money is going to be worth less. I fear for you, for me, for the people.

Subscribe to:

Posts (Atom)